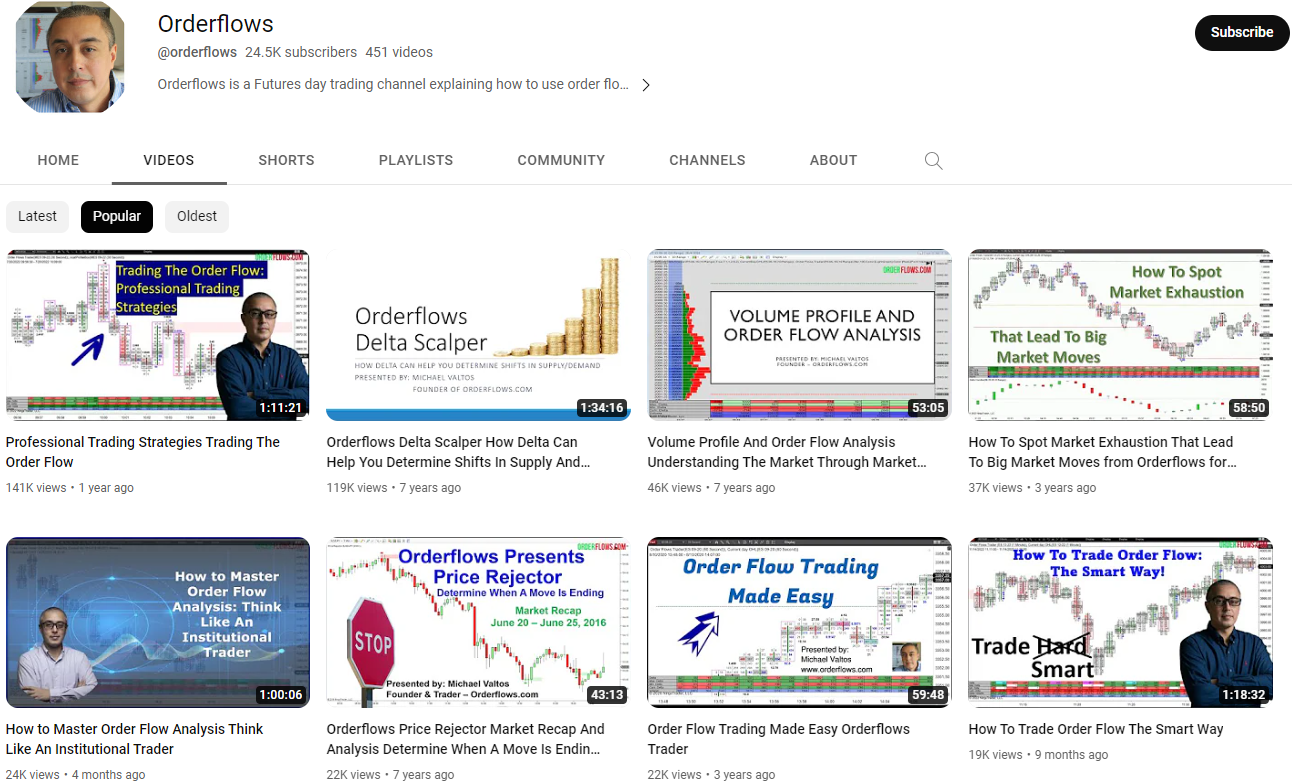

Download Mike Valtos – Order Flow Trading Course for Commodity, Forex and Stock Trading

My name is Michael Valtos and since 1994 I have been trading for banks (JP Morgan and Commerzbank) as well commodity trading houses (Cargill and EDF Man) and for myself. I created orderflows.com to help traders understand and trade with order flow.

In 2013 at the age of 44 I left JP Morgan and decided to trade for myself based on what I had learned along the way. The Futures industry has changed for the retail trader. Commission are now very low, real time data is not expensive and computers are cheap.

Most retail traders I talk to use indicators to make their trading decisions. MACD, RSI, moving averages, etc. In all my years dealing with hedge funds, proprietary traders and asset managers, I never once heard them say “I want to sell because the MACD is telling me to.” Rather institutional traders base their decisions on macro views of the world based on the price the market is trading at. They may think the price is cheap relative to where they forecast the market should be trading one month or even one year from now, so they buy. It is these views that help to move the market. Retail traders don’t understand that mathematical derivations of price is not what moves markets. Why not just follow what the market is telling you? There is such a stark difference in trading styles between retail traders and institutional traders.

Which side of the market would you rather be on? The 95% of the losing retail traders out there? Or the side of the institutional traders who move the market? Download course to learn more.

Throughout my career I had the good fortune to work with some of the largest traders in the world who would entrust their orders to me for execution. Orders like “buy 5,000 ESH5 over the next 15 minutes.” My goal was to get the best possible execution without impacting the market. I was measured against VWAP for the same time period as calculated on Bloomberg. You can’t just go in and buy 3,000 lots in one clip. You have to finesse it. You have to not show the world what you are trying to do until you are done. If everyone knows you are trying to buy a lot of contracts, they will raise their bids forcing you to pay higher or even jump ahead of you and buy before you can.

When you look at the trading screens all day every day, you start to notice how the orders come into the market and create opportunities and or distortions in the market. Creating pockets of opportunities to buy or sell at prices that are attractive. At the institutional level, order flow one of the most, if not the most important tool for traders when getting into and out of the market. Institutional traders generally have size positions to deal with, so getting in and out of them is not always easy. They need size to trade against. If there is no size, then the traders need to get aggressive. One thing is certain though, what the institutions do in the market will be reflected in the volume. You may not see it directly in the order book because of all the different ways to work an order. But large executed orders leave their footprint so to speak. I learned how to read the tracks left by other institutional traders to benefit my customers as well as my own trading. You can learn this course by downloading.

When a market moves up, it is not because the MACD crossed the zero line. The market moves up because the buyers are buying more than the sellers have to offer. When the market goes down, it is not because the 9 day moving average crossed the 30 day moving average. The market goes down because the sellers have control of the market. Fortunately, in today’s trading world, software and data feeds allow us to track and analyse the price a trade occurred, on the bid side or the offer side and its size. We now have three key pieces of market information instead of just one.

When you put all of these pieces together (price, volume traded on the bid, volume traded on the offer) you start to get a clearer picture of not only what is happening in the market and who is participating but also the direction the market. When you start to see big aggressive buyers or sellers appearing, you take notice. When you see highs made with little volume trading there you can be fairly certain buyers are not interested at those price levels. Order flow tells you all this and so much more. Once you start looking at order flow charts and understanding them you will not want to trade again without them.

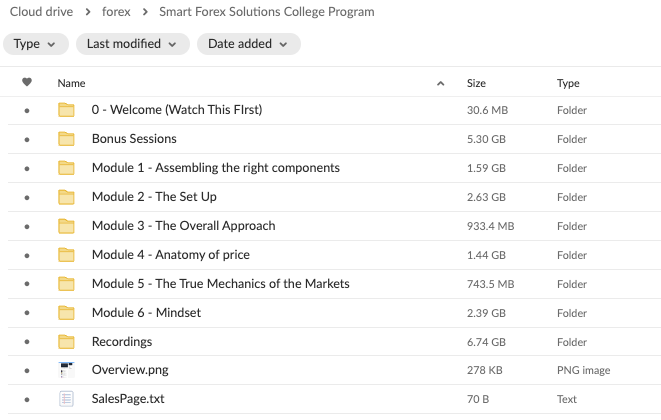

Download Mike Valtos – Order Flow Trading Course from Mydiscountcourses, the largest library of forex & stock trading courses.

At mydiscountcourses.com, we’ve pioneered a groundbreaking crowdfunding platform tailored specifically to download stock and forex trading courses. Our mission is clear: to break down financial barriers and make top-tier forex and stock trading courses easy to download and accessible to new forex trades from all walks of life.

[Download links for ALL COURSES in the library available to subscribers only.]